Type: Analysis Authors: @owocki

Sources:

ethereum has always had a culture of public goods funding. in this piece, i examine where the money comes from. money always has a source, and the source shapes behavior downstream. by studying the attributes of its sources, we may then reason about the shape, form, and longevity of how it flows (or doesnt flow).

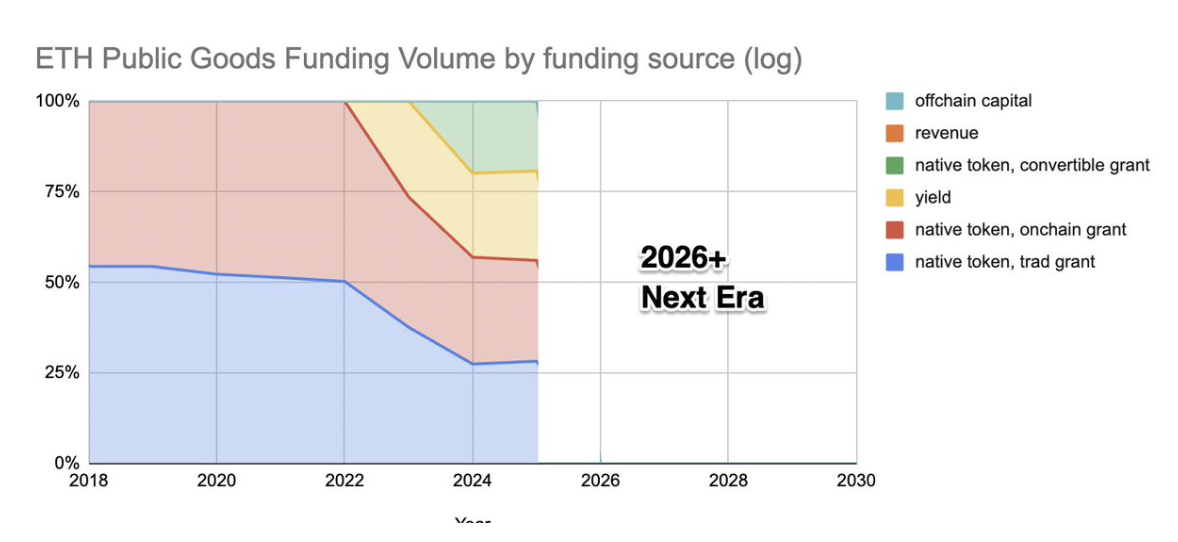

where funds have traditionally come from:

flush treasuries, native tokens, and grants

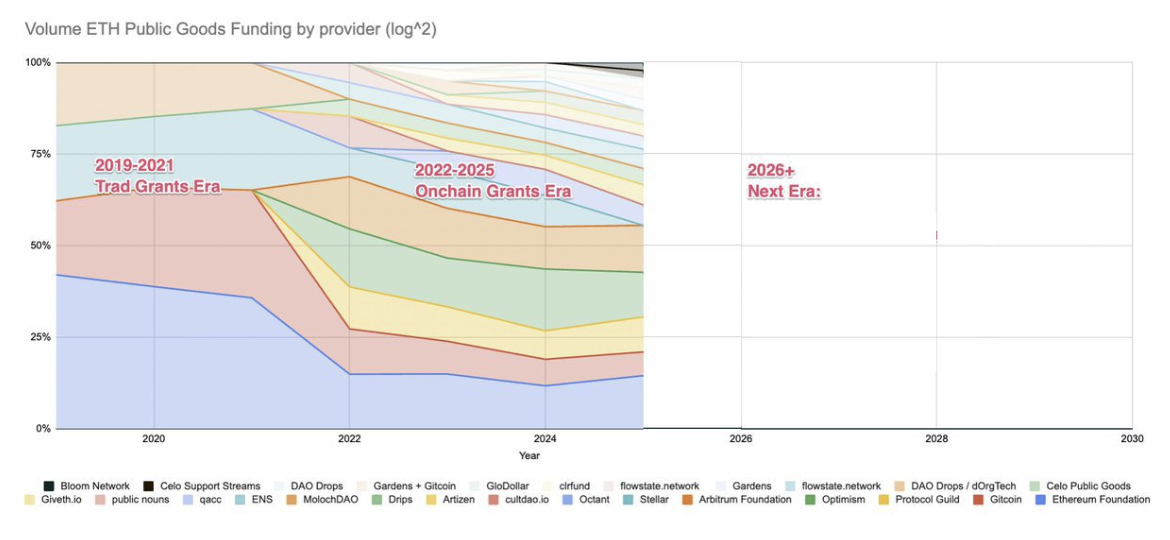

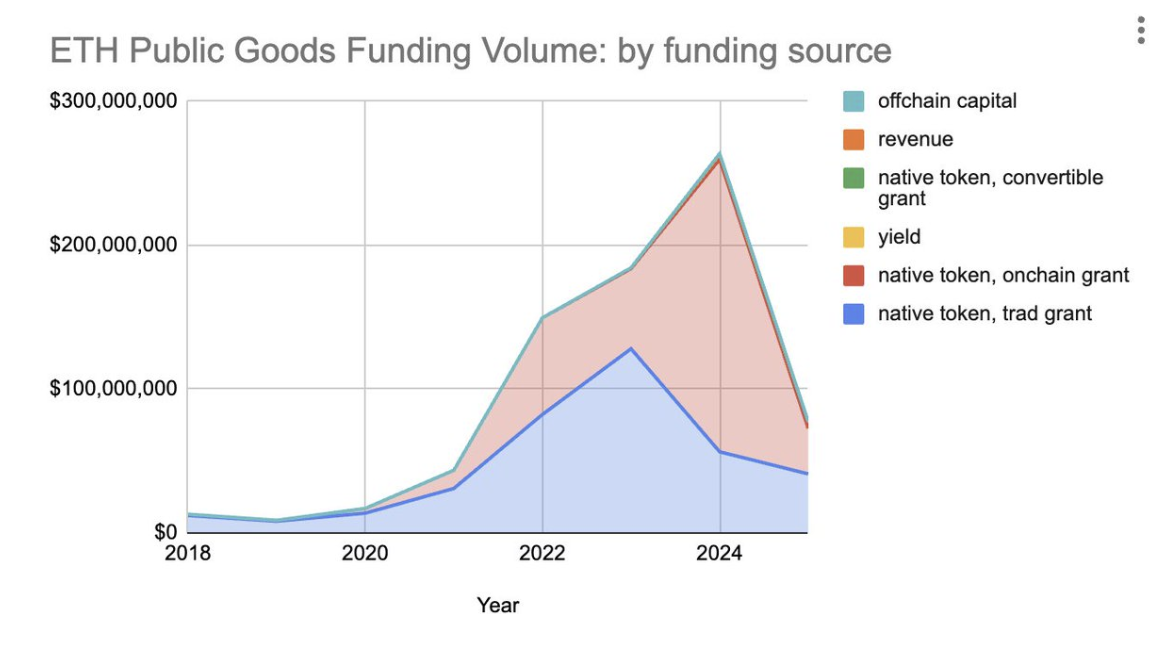

ETHUSD went through major bull markets in 2017 and 2021. this led to the 2018-2024 era most of ethereum’s history, where pgf was funded by large, relatively centralized treasuries.

l1 foundations, l2 foundations, defi foundations, and a handful of early dao treasuries were flush with cash. token prices were high, balance sheets looked strong, and the mandate was broad: fund the ecosystem.

incentives and motivations

the dominant incentive was stewardship and ecosystem growth. foundations wanted ethereum to succeed. l2s wanted adoption. everyone wanted developers. daos wanted to attract builders and signal long-term commitment.

this produced real good, but it also created soft incentives. when money is abundant and accountability is diffuse, funding drifts toward narrative coherence, social proximity, and comfort. good projects got funded. so did ones that persisted mainly because conditions were easy.

size of aperture

the aperture was wide. grants were often general-purpose, exploratory, and inclusive by design. this worked well in a formative phase when experimentation mattered more than efficiency. but wide apertures also meant weak selection pressure. when conditions tightened, these systems struggled to adapt.

during the 2022-2024 era, there were bold experiments and prominent campaigns at molochdao, gitcoin grants, optimism, and protoocol guild. many experiments in the design space blossomed.

why this model could fade

this model is not disappearing, but it may fade in importance.

especially in places where treasuries are smaller. scrutiny is higher. sustainability now requires proof, not just intent. the ecosystem has learned that hoping donors show up is not a durable funding strategy.

pgf is being pulled toward sources of capital that are structural, continuous, targeted, and incentive-aligned.

where pgf funds are going to come from in 2026+

1. yield

yield-based pgf changes the psychology of funding.

incentives and motivations

people are far more willing to allocate yield than principal. yield feels like excess. it avoids the sharp tradeoffs of spending down a treasury. structurally, yield-based systems align pgf with capital efficiency rather than capital depletion. support can persist without shrinking the base.

this creates a calmer, more durable funding environment. fewer heroic moments. more continuous flows.

size of aperture

moderate and steady. yield constrains excess, but it compounds over time. the aperture is narrower than grants, but it stays open longer.

leader: @octantapp

2. revenue

revenue is the most important long-term source of pgf.

incentives and motivations

when pgf is directly funded from protocol fees, sequencer fees, or application revenue, it becomes infrastructure maintenance. actors narrowly fund their ecosystems infra because they depend on it, and they want to signal longevity and upstream value flows. the motivation is uptime, reliability, and long-term competitiveness.

this is where fund your dependencies becomes operational. when upstream value is legible, capital flows naturally.

size of aperture

narrow but deep. revenue-based pgf has tight constraints. not everything qualifies. but what does qualify can be funded indefinitely.

leader: @deepfunding

3. off-chain capital

off-chain capital is changing its posture towards the onchain world.

incentives and motivations

philanthropy, corporate sponsorships, and aligned institutions still fund pgf, but with sharper expectations. they want leverage. they want systems that persist after the grant. they want proof that their capital unlocks impact or upside.

off-chain funders increasingly act as catalysts rather than sustainers.

size of aperture

episodic and strategic. wide at moments of transition. narrow in steady state. best used to bootstrap new mechanisms, not operate them indefinitely.

leader: @localismfund

4. convertable grants

between pure grants and pure revenue sits an important bridge: convertible grants.

incentives and motivations

convertible grants acknowledge uncertainty without abandoning discipline. funders support early-stage public goods before revenue is visible, but retain an option to convert into repayment, revenue share, or equity-like claims if the project later becomes sustainable or commercial.

this aligns incentives on both sides. builders get runway without premature monetization pressure. funders are not locked into permanent subsidy if the project crosses into viability. the motivation shifts from “fund forever” to “help you cross the chasm.”

convertible grants also reduce the stigma around success. projects do not need to contort themselves to stay grant-eligible. if you succeed, you pay it forward.

size of aperture

medium and adaptive. wider than revenue, tighter than traditional grants. the aperture starts open and narrows automatically as outcomes clarify. this makes convertible grants especially effective for frontier infrastructure, research-heavy work, and oss projects that may or may not find a sustainable model.

used well, convertible grants are not a compromise. they are a transition primitive. they help pgf systems move capital toward sustainability without demanding it upfront.

5. coalitional funding

this is the most underappreciated shift.

incentives and motivations

l2s, app-chains, protocols, and ecosystems fund their own dependencies. when those dependencies overlap, funding pools overlap. no single actor needs to fund the whole stack. everyone funds the part they rely on.

the motivation is capital efficiency. shared infrastructure gets funded because defection is costly.

size of aperture

many small apertures instead of one large one. individually constrained, collectively expansive. this is how pgf scales without centralization.

the arc we are on

we are moving from pgf as episodic allocation to pgf as a continuous system.

from flush treasuries to flowing revenue.

from wide, fragile apertures to narrower, durable ones.

grants were the right tool for an early era. they helped ethereum find product–ecosystem fit. but they were misleading because they flowed capital to places they could not reliably sustain.

imo the next era requires pgf to be legible to machines, defensible in adversarial conditions, and embedded in the economic fabric of the network.

imo pgf is maturing. it is evolving to fit the ecosystem it now lives in. an ecosystem that is more adversarial, more composable, and more real about constraints. the funding systems that survive will be the ones that learn how to move within the new environment, embedding themselves into this cycles themes: to me, that looks like revenue, yield, convertible grants, coalitional funding, and dependency flows.

this is what maturation looks like.

Funding sources over time

Funding campaigns over time